Multiple Choice

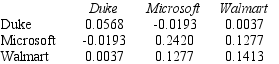

Use the table for the question(s) below.

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6000 investment in Duke Energy and a $4000 investment in Walmart stock is closest to:

A) .050.

B) .045.

C) .051.

D) -0.020.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Which of the following statements is FALSE?<br>A)Because

Q33: Use the table for the question(s)below.<br>Consider the

Q34: Use the information for the question(s)below.<br>Suppose that

Q35: Which of the following statements is FALSE?<br>A)Margin

Q36: What is the efficient frontier and how

Q38: Use the table for the question(s)below.<br>Consider the

Q39: Suppose that the risk-free rate is 5%

Q40: Which of the following statements is FALSE?<br>A)Graphically,the

Q41: Which of the following statements is FALSE?<br>A)To

Q42: Use the following information to answer the