Essay

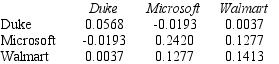

Use the table for the question(s)below.

Consider the following covariances between securities:

-What is the variance on a portfolio that has $2000 invested in Duke Energy,$3000 invested in Microsoft,and $5000 invested in Walmart stock?

Correct Answer:

Verified

Varianc...

Varianc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Suppose over the next year Ball Corporation

Q9: Which of the following equations is INCORRECT?<br>A)E[Rxp]

Q10: Which of the following equations is INCORRECT?<br>A)Cov(Ri,Rj)=

Q11: How is the optimal portfolio choice affected

Q12: Use the information for the question(s)below.<br>Tom's portfolio

Q14: You currently own $100,000 worth of Walmart

Q15: Use the information for the question(s)below.<br>Suppose that

Q16: Use the table for the question(s)below.<br>Consider the

Q17: Use the following information to answer the

Q18: Consider an equally weighted portfolio that contains