Multiple Choice

Use the following information to answer the question(s) below.

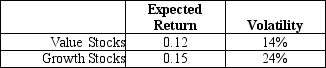

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The volatility on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

A) 13.5%.

B) 15.2%.

C) 17.1%.

D) 19.0%.

Correct Answer:

Verified

Correct Answer:

Verified

Q49: Use the following information to answer the

Q50: You currently own $100,000 worth of Walmart

Q51: Which of the following statements is FALSE?<br>A)When

Q52: Which of the following statements is FALSE?<br>A)The

Q53: Use the table for the question(s)below.<br>Consider the

Q55: The beta for the market portfolio is

Q56: Consider a portfolio consisting of only Microsoft

Q57: Which of the following statements is FALSE?<br>A)The

Q58: Use the information for the question(s)below.<br>Suppose you

Q59: Use the following information to answer the