Multiple Choice

Use the information for the question(s) below.

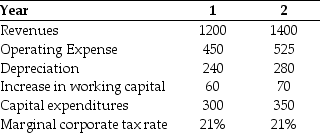

Shepard Industries is evaluating a proposal to expand its current distribution facilities.Management has projected the project will produce the following cash flows for the first two years (in millions) .

-The depreciation tax shield for the Shepard Industries project in year one is closest to:

A) $59 million.

B) $168 million.

C) $96 million.

D) $50 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q70: Use the following information to answer the

Q71: What is an opportunity cost? Should it

Q72: Use the following information to answer the

Q73: The value of currently unused warehouse space

Q74: Use the following information to answer the

Q76: Use the following information to answer the

Q77: Use the information for the question(s)below.<br>The Sisyphean

Q78: Use the information for the question(s)below.<br>Kinston Industries

Q79: What is a sunk cost? Should it

Q80: Use the information for the question(s)below.<br>Glucose Scan