Multiple Choice

Use the information for the question(s) below.

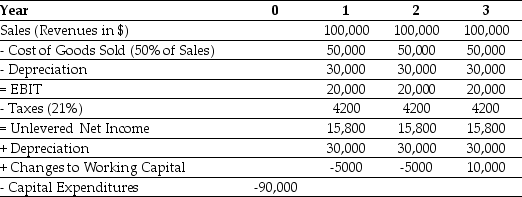

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-The NPV for Epiphany's Project is closest to:

A) $4825.

B) $39,000.

C) $18,671.

D) $20,400.

Correct Answer:

Verified

Correct Answer:

Verified

Q58: The difference between scenario analysis and sensitivity

Q59: Which of the following statements is FALSE?<br>A)The

Q60: Use the following information to answer the

Q61: Which of the following statements is FALSE?<br>A)Project

Q62: Which of the following statements is FALSE?<br>A)The

Q64: Use the information for the question(s)below.<br>The Sisyphean

Q65: Use the information for the question(s)below.<br>Epiphany Industries

Q66: Use the information for the question(s)below.<br>Shepard Industries

Q67: Which of the following statements is FALSE?<br>A)Because

Q68: Use the information for the question(s)below.<br>Epiphany Industries