Multiple Choice

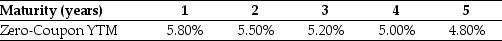

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The forward rate for year 2 (the forward rate quoted today for an investment that begins in one year and matures in two years) is closest to:

A) 5.80%.

B) 5.50%.

C) 5.20%.

D) 5.65%.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Consider a corporate bond with a $1000

Q17: Which of the following statements is FALSE?<br>A)Bond

Q18: Use the information for the question(s)below.<br>The Sisyphean

Q19: Use the following information to answer the

Q20: Which of the following statements is TRUE?<br>A)Prices

Q22: Use the following information to answer the

Q23: Based upon the information provided in the

Q24: Use the table for the question(s)below.<br>The following

Q25: Use the following information to answer the

Q26: Which of the following statements is FALSE?<br>A)Bond