Multiple Choice

Use the information for the question(s) below.

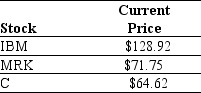

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) ,three shares of Merck (MRK) ,and three shares of Citigroup Inc.(C) .Suppose the current market price of each individual stock are shown below:

-Suppose that the ETF is trading for $666.95;you should:

A) sell the EFT and buy 2 shares of IBM,3 shares of MRK,and 3 shares of C.

B) sell the EFT and buy 3 shares of IBM,2 shares of MRK,and 3 shares of C.

C) buy the EFT and sell 2 shares of IBM,3 shares of MRK,and 3 shares of C.

D) do nothing,no arbitrage opportunity exists.

Correct Answer:

Verified

Correct Answer:

Verified

Q67: Use the information for the question(s)below.<br>An exchange

Q68: Use the information for the question(s)below. <img

Q69: Use the table for the question(s)below. <img

Q70: Use the information below to answer the

Q71: Which of the following formulas regarding NPV

Q73: Suppose you have $500 today and the

Q74: Which of the following statements regarding Net

Q75: Use the table for the question(s)below. <img

Q76: Use the information for the question(s)below. <img

Q77: Use the information for the question(s)below. <img