Multiple Choice

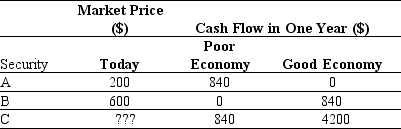

Use the table for the question(s) below.

-Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,what risk premium is appropriate for this security?

A) 4%

B) 6.5%

C) 9%

D) 11%

Correct Answer:

Verified

Correct Answer:

Verified

Q17: If the risk-free rate of interest (rf)is

Q18: In a normal market with transactions costs,is

Q19: Use the information below to answer the

Q20: Use the table for the question(s)below.<br>Consider the

Q21: Use the following information to answer the

Q23: Use the information for the question(s)below. <img

Q24: Use the information below to answer the

Q25: You have an investment opportunity in Germany

Q26: Use the table for the question(s)below. <img

Q27: Use the information below to answer the