Essay

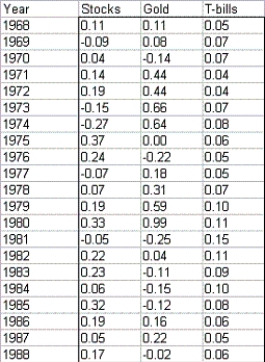

Your parents are discussing their retirement portfolio with you so that you can be informed not only about their holdings,but learn how to manage your own.The risk index of an investment can be obtained by taking the absolute values of percentage changes in the value of the investment for each year and averaging them.Suppose your dad asks you to determine what percentage of his money he should have invested in T-bills,gold,and stocks in the 1980s and 1990s based on data he provides for the years 1968-1988.The table below lists the annual returns (percentage changes in value)for these investments during these years.  Let the risk index of a portfolio be the weighted average of the risk indexes of these investments,where the weights are the fractions of your parents' money assigned to the investments.Suppose that the amount of each investment must be between 20% and 50% of the total invested.You would like the risk index of your portfolio to equal 0.15,and your goal is to maximize the expected return on your portfolio.Determine the maximum expected return on their portfolio,subject to the stated constraints.Use the average return earned by each investment during the years 1968-1988 as their estimate of expected return.

Let the risk index of a portfolio be the weighted average of the risk indexes of these investments,where the weights are the fractions of your parents' money assigned to the investments.Suppose that the amount of each investment must be between 20% and 50% of the total invested.You would like the risk index of your portfolio to equal 0.15,and your goal is to maximize the expected return on your portfolio.Determine the maximum expected return on their portfolio,subject to the stated constraints.Use the average return earned by each investment during the years 1968-1988 as their estimate of expected return.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: The flows in a general minimum cost

Q44: During the next four quarters,an automobile company

Q45: Transportation costs for a given route are

Q46: You should always look at the Solver

Q47: Many organizations must determine how to schedule

Q49: When we solve a linear programming problem

Q50: The transportation model is a special case

Q51: A product can be produced on four

Q52: In an optimized network flow model (MCNFM),all

Q53: Any integer programming problem involving 0-1 variables