Multiple Choice

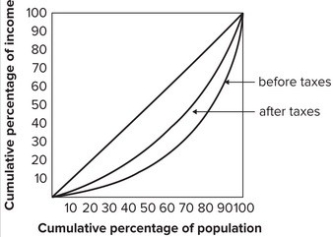

The graph shows that:

A) the effect of taxes is to make the distribution of income less equal.

B) the effect of taxes is to make the distribution of income more equal.

C) before-tax income and after-tax income are both equally distributed.

D) taxes are highly regressive.

Correct Answer:

Verified

Correct Answer:

Verified

Q90: Refer to the graph shown. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7145/.jpg"

Q91: Refer to the graph shown. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7145/.jpg"

Q92: Since the minimum food budget used to

Q93: For U.S. workers in tradable sectors such

Q94: According to official statistics in the United

Q95: Refer to the graph shown. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7145/.jpg"

Q96: Other things equal, tax cuts favoring the

Q97: An example of share distribution of income

Q99: Which of the following is not one

Q100: The underclass in the United States has