Multiple Choice

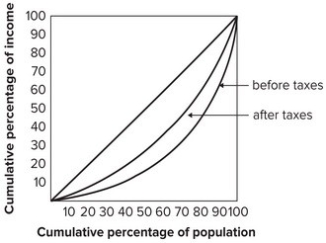

Refer to the graph shown.  A possible explanation for the difference between the distribution of income before taxes and the distribution of income after taxes shown in the graph is that the tax system:

A possible explanation for the difference between the distribution of income before taxes and the distribution of income after taxes shown in the graph is that the tax system:

A) is regressive.

B) is proportional.

C) is progressive.

D) does not affect income inequality.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: When a tax is progressive, the average

Q35: The program that redistributes the most money

Q36: The Lorenz curve would be a diagonal

Q37: A higher tax rate could result in

Q38: On its horizontal axis, a Lorenz curve

Q40: One study of the distribution of wealth

Q41: Real income will fall whenever:<br>A) prices and

Q42: Which of the following statements contradicts the

Q43: In most developed countries, the class system:<br>A)

Q44: Because the poor tend to use public