Multiple Choice

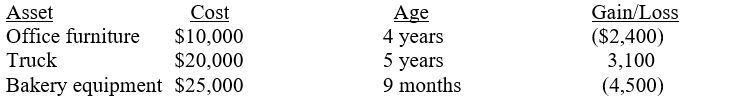

Angel sells the following depreciable assets from her sole proprietorship:

What should Angel report on her income tax return relative to each of these property transactions?

A) $3,800 capital loss

B) $3,100 Section 1245 recapture; $2,400 Section 1231 loss; $4,500 ordinary loss

C) $3,800 ordinary loss

D) $700 Section 1231 gain; $4,500 ordinary loss

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Cliff owned investment stock purchased three years

Q16: Clem and Chloe, a married couple, sell

Q17: Donza Company has unrecaptured Section 1231 losses

Q18: Which of the following is not a

Q19: The Walford Partnership (owned by two individuals)

Q21: All assets owned by a trade or

Q22: What are the carryover provisions for unused

Q23: Justin, who is single, sells his principal

Q24: Liam used his auto 70 percent for

Q25: Martone Corporation sells two machines and a