Multiple Choice

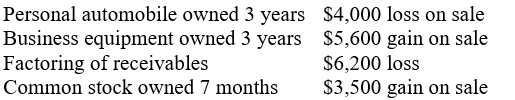

An individual taxpayer has the following property transactions during the current year:

How do these transactions affect the individual's AGI?

A) AGI is increased by $2,900

B) AGI is decreased by $1,100

C) AGI is increased by $9,100

D) AGI is decreased by $2,900

Correct Answer:

Verified

Correct Answer:

Verified

Q70: Ginger sold stock that she had purchased

Q71: On March 17, a calendar-year taxpayer sells

Q72: Lopez Corporation sold equipment that it had

Q73: Alpha Corporation had income from operations of

Q74: Which of the following comparisons is correct?<br>A)Both

Q76: The Section 1231 look-back rules change the

Q77: Ian and Mia married in early 2019

Q78: Wally (who is in the 24 percent

Q79: Kelly, a single individual, has $15,000 of

Q80: Lopez Corporation sold equipment that it had