Multiple Choice

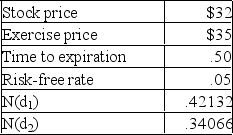

What is the value of a 6-month call with a strike price of $35 given the Black-Scholes Option Pricing Model and the following information?

A) $0

B) $0.13

C) $1.06

D) $1.85

E) $2.14

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q203: Neal owns a convertible bond that matures

Q204: Martha B's has total assets of $1,750.

Q205: A stock has a call with a

Q206: The value a convertible bond would have

Q207: The value of an American call option

Q209: Underlying stock price: 25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt="Underlying

Q210: You own both a May 20 call

Q211: Stock price Is a variables that is

Q212: Underlying stock price: 25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt="Underlying

Q213: Six months ago, you purchased a put