Multiple Choice

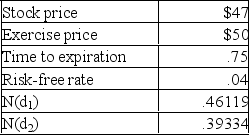

What is the value of a 9-month call with a strike price of $50 given the Black-Scholes Option Pricing Model and the following information?

A) $0

B) $0.26

C) $1.47

D) $1.90

E) $2.59

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q52: When the market interest rates increase, it

Q53: An American option is worth more than

Q54: In July, you purchase a September 75

Q55: You own five convertible bonds. These bonds

Q57: The Black-Scholes Option Pricing Model as it

Q58: Which of the following statements is false?<br>A)

Q59: Convertible bonds include an implicit call option.

Q60: Overallotment provisions include an implicit call option.

Q61: Peter owns ten European DFG 25 calls

Q174: C<sub>1</sub> = (S<sub>1</sub>- E) if (S<sub>1</sub>- E)