Multiple Choice

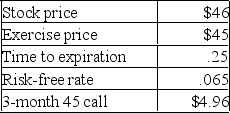

What is the value of a 3-month put with a strike price of $45 given the Black-Scholes Option Pricing Model and the following information?

A) $3.23

B) $3.40

C) $3.61

D) $4.03

E) $4.22

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q48: Last week,you purchased a call option on

Q123: What are the basic differences between warrants,

Q124: A _ is a _ on the

Q125: Underlying stock price: 25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt="Underlying

Q127: A European option can best be defined

Q129: The current market value of the assets

Q130: When a call is out of the

Q131: The primary purpose of a protective put

Q132: ESOs are sometimes used as a substitute

Q133: An option issued by an individual that