Multiple Choice

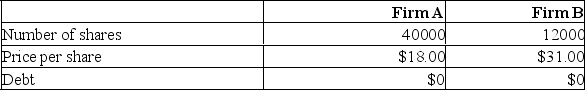

Firm B is willing to be acquired by firm A at a price of $34 a share in either cash or stock. The incremental value of the proposed acquisition is estimated at $80,000.  What is the price per share of firm AB if the merger is an all-stock deal?

What is the price per share of firm AB if the merger is an all-stock deal?

A) $18.00

B) $18.70

C) $18.80

D) $19.32

E) $21.00

Correct Answer:

Verified

Correct Answer:

Verified

Q89: Synergy is defined as the:<br>A) Positive incremental

Q90: FirstGuppy Corp. has just received a purchase

Q91: The value of a target firm to

Q92: An acquisition of a firm through the

Q93: Suppose the employees of Air Canada borrowed

Q95: Asset write-ups refers to synergistic gains due

Q96: Better use of tax losses is a

Q97: Firm A is acquiring Firm B for

Q98: The shareholders of a target firm benefit

Q99: Guido's and Elrod's are all-equity firms. Guido's