Multiple Choice

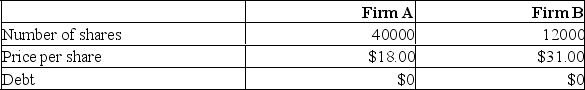

Firm B is willing to be acquired by firm A at a price of $34 a share in either cash or stock. The incremental value of the proposed acquisition is estimated at $80,000.  What is the value of one share of stock in AB if the merger is a cash deal?

What is the value of one share of stock in AB if the merger is a cash deal?

A) $18.00

B) $19.10

C) $20.00

D) $21.30

E) $25.47

Correct Answer:

Verified

Correct Answer:

Verified

Q29: A transaction involving only one firm, which

Q30: An increase in surplus funds represents potential

Q31: Provide a definition of a merger.

Q32: DEF stockholders are paid the current market

Q33: Firm B is willing to be acquired

Q35: All else equal, the cost of an

Q36: In the early 1900s, the Standard Oil

Q37: Bob's Bait Shop has 1,200 shares outstanding

Q38: In general, the evidence indicates that mergers

Q39: A friendly suitor that a target firm