Multiple Choice

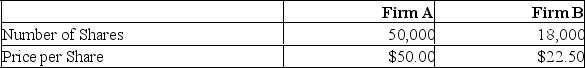

Neither acquiring firm A nor target firm B has any debt. The incremental value of the proposed acquisition is estimated to be $250,000. Firm B is willing to be acquired for $30 per share in cash.  What are the synergistic benefits that arise from the acquisition of firm B?

What are the synergistic benefits that arise from the acquisition of firm B?

A) $138,000

B) $250,000

C) $405,000

D) $655,000

E) $920,000

Correct Answer:

Verified

Correct Answer:

Verified

Q36: In the early 1900s, the Standard Oil

Q37: Bob's Bait Shop has 1,200 shares outstanding

Q38: In general, the evidence indicates that mergers

Q39: A friendly suitor that a target firm

Q40: The primary difference between a merger and

Q42: Bureaucratic obstacles are often eliminated in leveraged

Q43: When one group of shareholders transfers control

Q44: Trailer World is being acquired by Northern

Q45: An attempt to gain control of a

Q46: Mergers can be financed with either cash