Multiple Choice

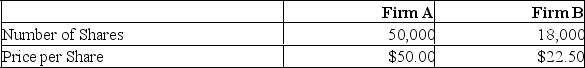

Neither acquiring firm A nor target firm B has any debt. The incremental value of the proposed acquisition is estimated to be $250,000. Firm B is willing to be acquired for $30 per share in cash.  What is the merger premium per share in this case?

What is the merger premium per share in this case?

A) $0

B) $2.50

C) $7.50

D) $10.00

E) $30.00

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q73: Which of the following accurately completes the

Q74: Which of the following is the best

Q75: Corporate charter provisions allowing existing shareholders to

Q76: Firm X is being acquired by Firm

Q77: The payments made by a firm to

Q79: An increase in firm size so that

Q80: Firm B is willing to be acquired

Q81: Metal Works, Inc. has $3.8 million in

Q82: When Firm A acquired Firm B, no

Q83: Which of the following is the best