Multiple Choice

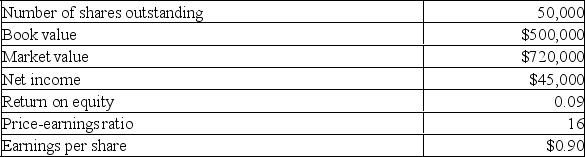

The Jenkins Co. is considering a project which requires the purchase of $315,000 of fixed assets. The net present value of the project is $20,000. Equity shares will be issued as the sole means of financing the project. The price-earnings ratio of the project equals that of the existing firm. What will the new market value per share be after the project is implemented given the following current information on the firm?

A) $10.00

B) $10.37

C) $12.07

D) $14.68

E) $15.04

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The Do Drop Inn requires $1.5 million

Q6: A general cash offer is an offering

Q7: Each of the following is sometimes performed

Q8: Calculate the value of a right given

Q9: _ considered an indirect flotation cost.<br>A) The

Q11: A Toronto firm is considering a new

Q12: The main difference between direct private long-term

Q13: Historically, IPO underpricing:<br>A) Ranges between 2 and

Q14: Assume that Classique decides to set the

Q15: Winter's Edge needs $45 million to finance