Multiple Choice

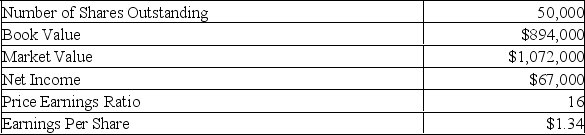

Bartow Industrial is reviewing a new proposal which will require $360,000 of new fixed assets. The net present value of the project is $84,000. The price-earnings ratio of the project equals that of the existing firm. What will the new book value per share be after the project is implemented given the following current information on the firm?

A) $16.22

B) $18.77

C) $22.47

D) $23.61

E) $25.08

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Which one of the following statements concerning

Q48: The Big Burger Co. has 225,000 shares

Q49: Adak currently owns 10 % of Earthworks,

Q50: Wexford Industries offers 60,000 shares of common

Q51: Empirical evidence suggests that the market price

Q53: Manvir Corporation currently has 120,000 shares outstanding

Q54: If a firm's articles of incorporation contain

Q55: _ is generally difficult funding to obtain

Q56: Summit Health Care is sponsoring a rights

Q57: With Dutch auction underwriting:<br>A) Each winning bidder