Multiple Choice

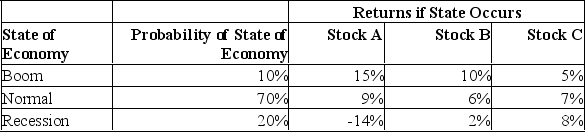

What is the standard deviation of a portfolio which is invested 20% in stock A, 30% in stock B and 50% in stock C?

A) 0.6%

B) 0.9%

C) 1.8%

D) 2.2%

E) 4.9%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: According to the CAPM,the expected return on

Q85: An investment firm is considering a portfolio

Q86: You own the following portfolio of stocks.

Q87: The majority of the benefits from portfolio

Q88: Assume all of the stocks in a

Q89: The market risk premium of an individual

Q92: The reward for bearing risk in the

Q93: The Capital Asset Pricing Model (CAPM) assumes

Q94: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" Which security has

Q95: The expected return on a portfolio:<br>A) Can