Multiple Choice

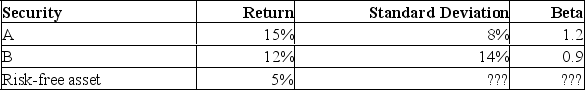

What is the portfolio expected return and the portfolio beta if you invest 30% in A, 30% in B and 40% in the risk-free asset?

What is the portfolio expected return and the portfolio beta if you invest 30% in A, 30% in B and 40% in the risk-free asset?

A) 9.6%; 1.32

B) 9.6%; 1.00

C) 10.1%; 0.95

D) 10.1%; 0.72

E) 10.1%; 0.63

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: The rate of return on the common

Q16: Draw the SML and plot asset C

Q345: Diversifiable risks are generally associated with an

Q347: For a stock with beta equal to

Q348: What is the standard deviation of a

Q350: The excess return earned by an asset

Q351: What is the portfolio weight of stock

Q352: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q353: Is it possible for an asset to

Q354: You form a portfolio by investing equally