Multiple Choice

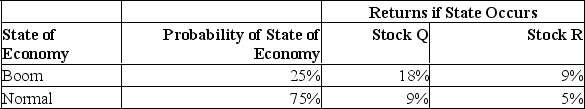

What is the standard deviation of a portfolio that is invested 40% in stock Q and 60% in stock R?

A) 0.7%

B) 1.4%

C) 2.6%

D) 6.8%

E) 8.1%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q60: A stock has a beta of.8 and

Q61: You own 40 shares of stock A,

Q62: Which of the following is a true

Q63: The weights that are commonly used when

Q64: You own a portfolio with the following

Q66: If you invest in stocks with higher-than-average

Q67: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q68: Market risk premium is needed to estimate

Q70: If the actual return on an investment

Q122: Which one of the following statements is