Multiple Choice

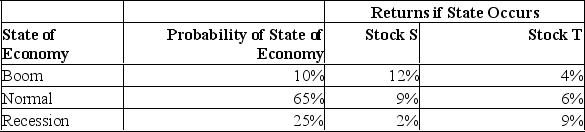

What is the standard deviation of a portfolio which is comprised of $4,500 invested in stock S and $3,000 in stock T?

A) 1.4%

B) 1.9%

C) 2.6%

D) 5.7%

E) 7.2%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q161: Diversifiable risks:<br>A) Are measured by beta.<br>B) Affect

Q162: The Capital Asset Pricing Model specifically rewards

Q163: If the total risk of firm X

Q164: What is the expected return on this

Q165: A firm in Moose Jaw announces a

Q167: The security market line:<br>A) Is a quadratic

Q168: Which one of the following events is

Q169: Stocks with a beta equal to the

Q170: A portfolio has an expected return of

Q171: The amount of systematic risk present in