Multiple Choice

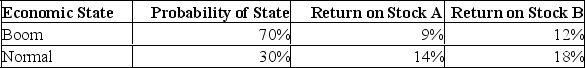

What is the standard deviation of a portfolio that is invested 40% in stock A and 60% in stock B, given the following information?

A) 2.18%

B) 2.57%

C) 2.69%

D) 2.84%

E) 3.13%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q309: Lower trade deficit than expected is considered

Q310: The returns on the common stock of

Q311: What is the expected return on a

Q312: XYZ Investment Corporation is considering a portfolio

Q313: The systematic risk of the market is

Q315: The reward-to-risk ratio can be defined as

Q316: Individual investors:<br>A) Should expect to earn a

Q317: What is the expected return for the

Q318: The _ tells us that the expected

Q319: Which one of the following statements is