Multiple Choice

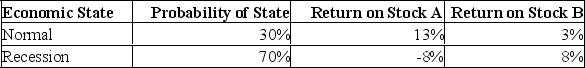

What is the standard deviation of a portfolio that is invested 60% in stock A and 40% in stock B, given the following information?

A) 1.58%

B) 2.36%

C) 4.06%

D) 4.86%

E) 5.51%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q103: Which one of the following statements is

Q188: The common stock of PDS has a

Q189: Which one of the following is an

Q190: ABC Investment Corporation is considering a portfolio

Q191: Asset A, which has an expected return

Q192: Provide a definition for beta coefficient.

Q194: Beta measures diversifiable risk.

Q195: Which of the following describes a portfolio

Q196: The _ portion of the total return

Q197: You are looking at two different stocks.