Multiple Choice

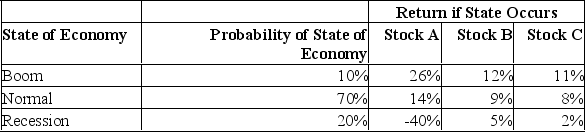

What is the standard deviation of a portfolio which is invested 10% in stock A, 35% in stock B and 55% in stock C?

A) 4.39%

B) 4.54%

C) 4.67%

D) 5.02%

E) 5.34%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q105: Unsystematic risk is rewarded when it exceeds

Q106: What is the portfolio beta if 75%

Q107: If the portfolio beta is greater than

Q108: If the standard deviation of return on

Q109: What is the standard deviation of a

Q111: Consider a portfolio made up of two

Q112: What relationship are the volatilities of stock

Q113: The systematic risk principle implies that the

Q114: What is the beta of a portfolio

Q115: The percentage of a portfolio's total value