Multiple Choice

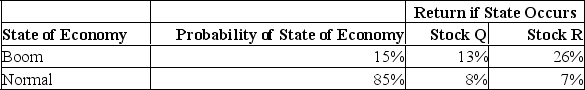

What is the standard deviation of a portfolio that is invested 30% in stock Q and 70% in stock R?

A) 1.22%

B) 3.93%

C) 5.28%

D) 8.03%

E) 11.47%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q37: Zelo,Inc. stock has a beta of 1.23.

Q121: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q122: What is the standard deviation of a

Q123: The expected return of the portfolio considers

Q124: What is the expected portfolio return given

Q125: Assume you are looking at a graph

Q127: What is the expected return on the

Q128: For a stock with beta equal to

Q129: The market risk premium of an individual

Q131: What is the expected return on a