Multiple Choice

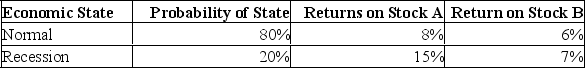

What is the expected return on a portfolio that is invested 30% in stock A and 70% in stock B, given the following information?

A) 5.28%

B) 6.60%

C) 7.16%

D) 7.43%

E) 7.90%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q224: You want your portfolio beta to be

Q225: Slope of the SML = [E(R<sub>A)</sub> +

Q226: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q227: The risk-free rate of return is 3.78%

Q228: Which of the following is the best

Q230: The expected return of the portfolio considers

Q231: A particular risky asset's risk premium, measured

Q232: Which of the following is the best

Q233: According to the capital asset pricing model:<br>A)

Q234: You recently purchased a stock that is