Multiple Choice

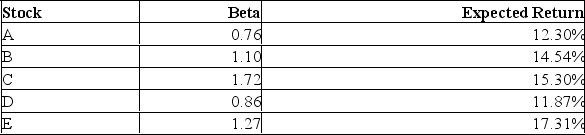

Which one of the following stocks is correctly priced if the risk-free rate of return is 4.2% and the market rate of return is 13.6%?

A) A

B) B

C) C

D) D

E) E

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q320: What is the expected return for the

Q321: An investor has a portfolio comprised of

Q322: Provide a definition for market risk premium.

Q323: Based upon the capital asset pricing model,

Q324: Non-diversifiable risks are those risks you cannot

Q326: Diversification works because unsystematic risk exists.

Q327: The security market line can be defined

Q328: Explain what we mean when we say

Q329: Adding some Treasury bills to a risky

Q330: Lower quarterly sales for Chapters than expected