Multiple Choice

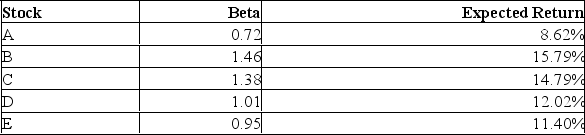

Which one of the following stocks is correctly priced if the risk-free rate of return is 3.2% and the market risk premium is 8.4%?

A) A

B) B

C) C

D) D

E) E

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: A stock has a beta of 1.4

Q4: Standard deviation measures the _ risk and

Q5: Which of the following is true concerning

Q6: A stock with an actual return that

Q7: The _ divided by the beta of

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q10: Provide a definition for expected return.

Q11: The concept of stock correlation shows:<br>A) The

Q12: What is the expected return on a

Q13: Assume you are looking at a graph