Multiple Choice

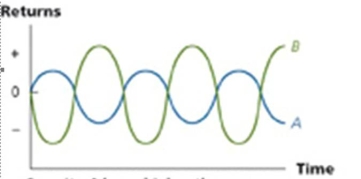

What relationship are the volatilities of stock A and B exhibiting?

A) Positive correlation.

B) Negative correlation

C) No correlation

D) Unsystematic correlation.

E) Systematic correlation.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q113: The systematic risk principle implies that the

Q114: What is the beta of a portfolio

Q115: The percentage of a portfolio's total value

Q116: Which one of the following is an

Q117: Which of the following statements is false?<br>A)

Q119: A portfolio is comprised of five risky

Q120: Diversification works because firm-specific risk can be

Q121: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q122: What is the standard deviation of a

Q123: The expected return of the portfolio considers