Multiple Choice

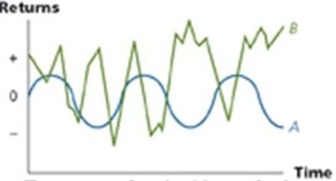

What relationship are the volatilities of stock A and B exhibiting?

A) Positive correlation.

B) Negative correlation

C) No correlation

D) Unsystematic correlation.

E) Systematic correlation.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q379: When computing the expected return on a

Q380: Which of the following is the best

Q381: An investor has purchased a gold stock.

Q382: Write out the equation for the CAPM.

Q383: What is the standard deviation of the

Q385: Using the Capital Asset Pricing Model (CAPM),

Q386: The stock of Jen's Boutique has a

Q387: The expected return of the portfolio considers

Q388: Non-diversifiable risk is relevant to a well-diversified

Q389: Ed Lawrence has $100,000 invested. Of that,