Multiple Choice

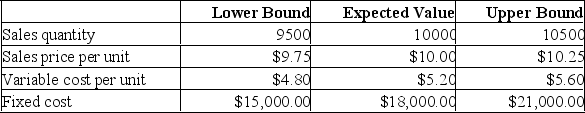

Magellen Industries is analyzing a new project. The data they have gathered to date is as follows:  Initial requirement for equipment: $120,000

Initial requirement for equipment: $120,000

Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Required rate of return: 15%

Marginal tax rate: 35%

What is the operating cash flow under the base-case scenario?

A) -$34,351

B) -$11,665

C) $0

D) $22,476

E) $30,000

Correct Answer:

Verified

Correct Answer:

Verified

Q341: When firms do not have sufficient available

Q342: A project has earnings before interest and

Q343: Variable costs minus fixed costs equal marginal

Q344: When firms do not have sufficient available

Q345: Variable costs can be forecast with a

Q347: A project with IRR = _ just

Q348: All else the same, if you decrease

Q349: A project has the following estimated data:

Q350: If a firm's fixed costs are exactly

Q351: An analysis of what happens to NPV