Multiple Choice

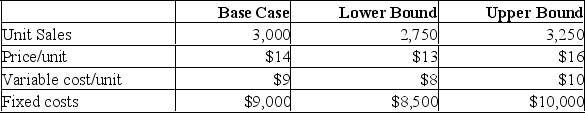

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings in the year in which the loss occurs. Additional information for variables with forecast error are shown below.  Suppose you are interested in the project's sensitivity to unit price. What is the NPV at a price of $13 per unit?

Suppose you are interested in the project's sensitivity to unit price. What is the NPV at a price of $13 per unit?

A) -$10,967

B) -$1,029

C) $105

D) $1,868

E) $2,056

Correct Answer:

Verified

Correct Answer:

Verified

Q156: How do the accounting, cash, and financial

Q157: An analysis of what happens to the

Q158: In a financial break-even calculation, the payback

Q159: Which of the following best describe the

Q160: All else equal, if you decrease your

Q162: The option to wait may be of

Q163: Describe how the inclusion of a strategic

Q164: Which of the following statements is NOT

Q165: The management of the Wish We Could

Q166: An analysis of what happens to NPV