Multiple Choice

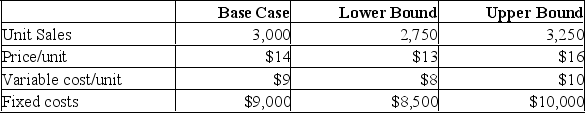

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings in the year in which the loss occurs. Additional information for variables with forecast error are shown below.  What is the best case NPV for the project?

What is the best case NPV for the project?

A) $5,247

B) $26,462

C) $29,306

D) $32,327

E) $34,252

Correct Answer:

Verified

Correct Answer:

Verified

Q17: An allocation method used to control overall

Q18: Costs that change in direct relation to

Q19: The accounting break-even point has an internal

Q20: Which of the following best describe the

Q21: What is the base case accounting break-even

Q23: Forecasting risk is defined as the:<br>A) Potential

Q24: All else the same, if a firm

Q25: A project has the following estimated data:

Q26: Variable costs can be ascertained with certainty

Q27: Wilson's Antiques is considering a project that