Multiple Choice

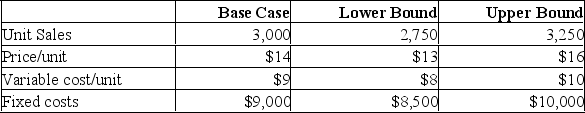

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings in the year in which the loss occurs. Additional information for variables with forecast error are shown below.  What is the worst case NPV for the project?

What is the worst case NPV for the project?

A) -$11,594

B) -$10,967

C) -$4,423

D) -$2,327

E) +$3,677

Correct Answer:

Verified

Correct Answer:

Verified

Q61: A proposed project has fixed costs of

Q273: A project with a low degree of

Q274: The company is conducting a sensitivity analysis

Q275: When conducting a worst-case scenario analysis, you

Q276: A project has the following estimated data:

Q277: Forecasting risk emphasizes the point that the

Q279: A project has a discounted payback period

Q280: The Interstate Hotel is considering building a

Q281: Which of the following best describe the

Q283: In previous chapters, we calculated NPV based