Multiple Choice

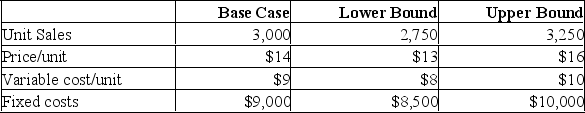

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings in the year in which the loss occurs. Additional information for variables with forecast error are shown below.  What is the base case NPV for the project?

What is the base case NPV for the project?

A) $1,523

B) $4,974

C) $5,247

D) $6,529

E) $8,281

Correct Answer:

Verified

Correct Answer:

Verified

Q320: The sales level that results in a

Q321: Sensitivity analysis helps you determine the:<br>A) Range

Q322: You have put together a set of

Q323: The financial break-even point is defined as

Q324: BASIC INFORMATION: A three-year project will cost

Q326: Which one of the following statements is

Q327: The Franklin Co. is analyzing a proposed

Q328: A project that just breaks even on

Q329: Given the following information, calculate OCF at

Q330: A firm that substitutes labour for machinery