Multiple Choice

Magellen Industries is analyzing a new project. The data they have gathered to date is as follows:  Initial requirement for equipment: $120,000

Initial requirement for equipment: $120,000

Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Required rate of return: 15%

Marginal tax rate: 35%

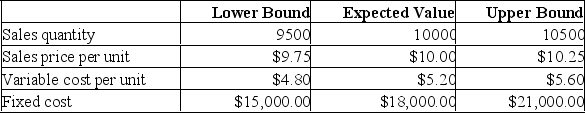

What is the degree of operating leverage under the worst-case scenario?

A) .93

B) 1.07

C) 1.63

D) 1.93

E) 2.07

Correct Answer:

Verified

Correct Answer:

Verified

Q67: Ralph and Emma's is considering a project

Q69: A project that just breaks even on

Q70: Given the following information, what is the

Q71: The investment timing decision relates to:<br>A) How

Q72: After ten years as a general auto

Q73: A project has expected sales of 21,000

Q75: Taylor and Ashcroft is reviewing a new

Q77: A project that just breaks even on

Q78: If a firm's fixed costs are exactly

Q79: The Franklin Co. is analyzing a proposed