Multiple Choice

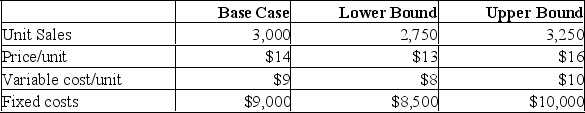

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings in the year in which the loss occurs. Additional information for variables with forecast error are shown below.  Suppose you want to conduct a sensitivity analysis for the possible changes in unit sales. What is the IRR when the sales level equals 3,250 units?

Suppose you want to conduct a sensitivity analysis for the possible changes in unit sales. What is the IRR when the sales level equals 3,250 units?

A) 32.6%

B) 42.8%

C) 57.9%

D) 118.6%

E) 121.5%

Correct Answer:

Verified

Correct Answer:

Verified

Q82: A project has earnings before interest and

Q103: Which one of the following statements concerning

Q104: To increase the contribution margin a firm

Q105: The possibility that errors in projected cash

Q106: Taking into account the managerial options implicit

Q107: The accounting break-even production quantity for a

Q109: A golf course/property developer buys twice as

Q110: The percentage change in firm (or project)

Q112: Which of the following does NOT correctly

Q113: Provide a definition for the term simulation