Multiple Choice

Magellen Industries is analyzing a new project. The data they have gathered to date is as follows:  Initial requirement for equipment: $120,000

Initial requirement for equipment: $120,000

Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Required rate of return: 15%

Marginal tax rate: 35%

The project is operating at the ________ under the base-case scenario.

A) Most profitable level.

B) Accounting break-even level.

C) Point where the IRR is equal to -100%.

D) Financial break-even point.

E) Cash break-even level.

Correct Answer:

Verified

Correct Answer:

Verified

Q407: A project that just breaks even on

Q408: Sara Lee has noted that every time

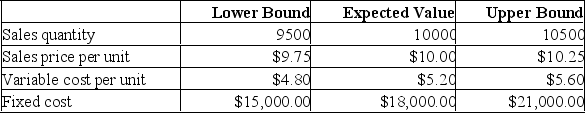

Q409: If you are contrasting the most optimistic

Q410: Fixed costs _.<br>A) Change as a function

Q411: The company is conducting a sensitivity analysis

Q413: DJ Studios is considering opening a new

Q414: A proposed project has fixed costs of

Q415: Opportunities that managers can exploit if certain

Q416: What is the cash break-even point? Price

Q417: A project has earnings before interest and