Multiple Choice

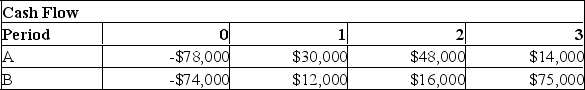

Your company accepts projects with a two year or less payback period. What should you do based on the following information?

A) Accept project A and reject project B.

B) Accept project B and reject project A.

C) Accept both project A and project B.

D) Reject both project A and project B.

E) Extend the payback period for project A since it has a higher initial cost, which would make.

Correct Answer:

Verified

Correct Answer:

Verified

Q392: Capital budgeting decisions generally:<br>A) Have long-term effects

Q393: In actual practice, managers frequently use the

Q394: For which capital investment evaluation technique is

Q395: Jackson Traders is considering two mutually exclusive

Q396: A project has an initial cost of

Q398: Sun, Inc. is analyzing two projects. Project

Q399: If financial managers only invest in projects

Q400: If a project has a net present

Q401: The average accounting return (AAR) rule can

Q402: The final decision on which one of