Multiple Choice

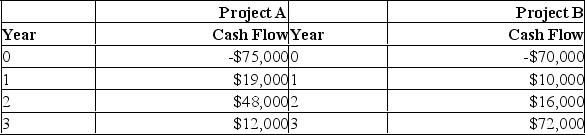

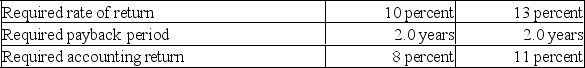

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.

Neither project has any salvage value.

Based upon the profitability index (PI) and the information provided in the problem, you should:

Based upon the profitability index (PI) and the information provided in the problem, you should:

A) Accept both project A and project B.

B) Accept project A and reject project B.

C) Accept project B and reject project A.

D) Reject both project A and project B.

E) Disregard the PI method in this case.

Correct Answer:

Verified

Correct Answer:

Verified

Q199: You are analyzing a project and have

Q200: An investment's average net income divided by

Q201: A project has an initial cost of

Q202: Net present value:<br>A) Cannot be used when

Q203: The Winston Co. is considering two mutually

Q205: The Jensen Company has compiled the following

Q206: You are considering two independent projects with

Q207: Without using formulas, provide a definition of

Q208: The difference between the market value of

Q209: Consider a project with an initial investment