Multiple Choice

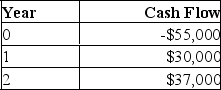

You would like to invest in the following project.  Victoria, your boss, insists that only projects that can return at least $1.10 in today's dollars for every $1 invested can be accepted. She also insists on applying a 10 % discount rate to all cash flows. Based on these criteria, you should:

Victoria, your boss, insists that only projects that can return at least $1.10 in today's dollars for every $1 invested can be accepted. She also insists on applying a 10 % discount rate to all cash flows. Based on these criteria, you should:

A) Accept the project because it returns almost $1.22 for every $1 invested.

B) Accept the project because it has a positive PI.

C) Accept the project because the NPV is $2,851.

D) Reject the project because the PI is 1.05.

E) Reject the project because the IRR exceeds 10 %.

Correct Answer:

Verified

Correct Answer:

Verified

Q347: A project costs $12,500 to initiate. Cash

Q348: If a project is assigned a required

Q349: Which one of the following statements is

Q350: The average accounting return is defined as

Q351: The payback rule can be best stated

Q353: You are analyzing the following two mutually

Q354: Desiree, Inc. is considering adding a new

Q355: Calculate the NPV of the following project

Q356: A project has a required return of

Q357: The crossover point is useful when trying