Multiple Choice

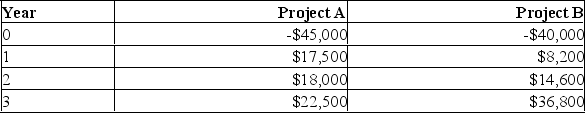

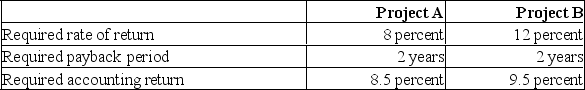

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

You should accept Project _____ because its net present value exceeds that of the other project by _____.

You should accept Project _____ because its net present value exceeds that of the other project by _____.

A) A; $418.02

B) A; $897.13

C) B; $656.94

D) B; $778.11

E) B; $813.27

Correct Answer:

Verified

Correct Answer:

Verified

Q208: The difference between the market value of

Q209: Consider a project with an initial investment

Q210: The principle that an investment should be

Q211: A 25- year project has a cost

Q212: A 30 year project is estimated to

Q214: What is the payback period of a

Q215: The average accounting return calculation takes the

Q216: A project costs $475 and has cash

Q217: A project has been assigned a required

Q218: Calculate the IRR of a 20-year project