Multiple Choice

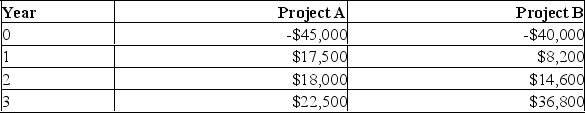

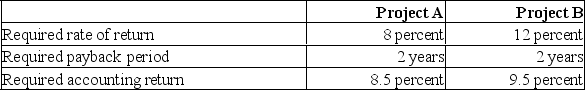

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

You should accept Project _____ because its internal rate of return (IRR) is _____ %.

You should accept Project _____ because its internal rate of return (IRR) is _____ %.

A) A; 13.22

B) A; 14.67

C) B; 13.92

D) B; 17.79

E) The IRR should not be used to determine which of these projects should be accepted.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: The average accounting return could lead to

Q36: The following four-year project has an initial

Q37: The payback period is defined as the

Q38: When comparing the payback and discounted payback

Q39: The internal rate of return (IRR) is

Q41: The internal rate of return for a

Q42: Compare and contrast the advantages and disadvantages

Q43: A firm seeks to accept projects with

Q44: For a project with conventional cash flows,

Q45: All else constant, the net present value