Multiple Choice

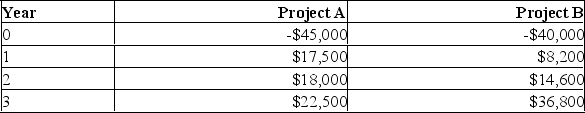

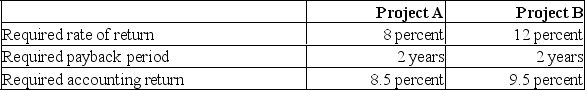

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

You should accept Project ____ because it has the _____ profitability index of the two projects.

You should accept Project ____ because it has the _____ profitability index of the two projects.

A) A; higher

B) A; lower

C) B; higher

D) B; lower

E) The profitability index should not be used to determine which of these projects should be accepted.

Correct Answer:

Verified

Correct Answer:

Verified

Q118: A negative net present value indicates that:<br>A)

Q119: An increased availability of computers and financial

Q120: Which of the following decision rules has

Q121: An increasing emphasis by financial executives on

Q122: You need to borrow $2,000 quickly, and

Q124: Generally, the most difficult part of utilizing

Q125: Project A has a cost of $300

Q126: A project produces annual net income of

Q127: Which capital investment evaluation technique is described

Q128: When the decision to accept or reject