Multiple Choice

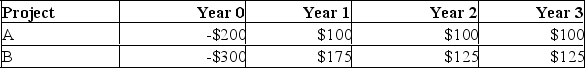

If the discount rate is 14% and the firm has limited funds, which of the following is true?

If the discount rate is 14% and the firm has limited funds, which of the following is true?

A) The PI of project A is less than 1.0.

B) The PI of project B is less than 1.0.

C) Based on the PI rule, project A is preferable.

D) Both projects would be rejected based on the PI rule.

E) The project with the smaller initial investment always has the higher PI.

Correct Answer:

Verified

Correct Answer:

Verified

Q272: A 30 year project is estimated to

Q273: The internal rate of return method of

Q274: The payback calculation takes the time value

Q275: A manager will prefer the IRR rule

Q276: Net present value is a highly valued

Q278: The length of time needed to recover

Q279: You are analyzing a project and have

Q280: The profitability index (PI) rule can be

Q281: An independent project has conventional cash flows

Q282: The net present value (NPV) rule can